Federal solar incentives after 2025: what actually changed in 2026

If you heard the federal solar “tax credit” ended in 2025 and assumed solar is off the table, you’re not alone. Here’s what actually shifted in 2026, and how the new setup shows up on your bill, protections, and savings.

A lot of homeowners walked into 2026 thinking they missed the boat. For years, the story was simple: buy solar, file for a credit, and recoup a chunk of the cost at tax time. Then the calendar flipped, the old rules sunset, and confusion took over. Did the benefits vanish? Are incentives gone? Not quite.

This is a policy-level view of federal solar incentives after 2025: what changed and when, who now interfaces with those incentives, and what that means for your home in 2026. Step-by-step program mechanics and point-by-point comparisons live in related guides. Treat this as the who, what, and when primer that supports our broader guide to the new solar incentive landscape after 2025.

Key Takeaway

Federal benefits didn’t disappear in 2026, they shifted. Instead of homeowners filing paperwork, approved program providers apply incentives directly, which is why plans like Incentive-Backed Solar™ can show day-one savings without a credit on your tax return.

The short version: incentives shifted, not vanished

Before 2026, Legacy Ownership was built on a familiar pattern: you paid for a system with cash or a loan, then you tried to claim a federal credit if you had enough tax liability. In 2026, that path ended. But the federal goal, encourage clean energy adoption, didn’t. The mechanism changed.

Here’s the thing: incentives now flow through qualified aggregators and financiers. They capture the federal value and blend it into the plan’s pricing from the start. For homeowners, that means no waiting, no complicated forms, and no hoping your tax situation lines up. The benefits are reflected in your monthly rate and in program protections.

This is why we talk about Incentive-Backed Solar™. The incentives are still there; they’re just delivered differently. And because they’re applied on the front end, the savings can show up on day one instead of at tax time months later.

What changed when: 2024–2027 timeline

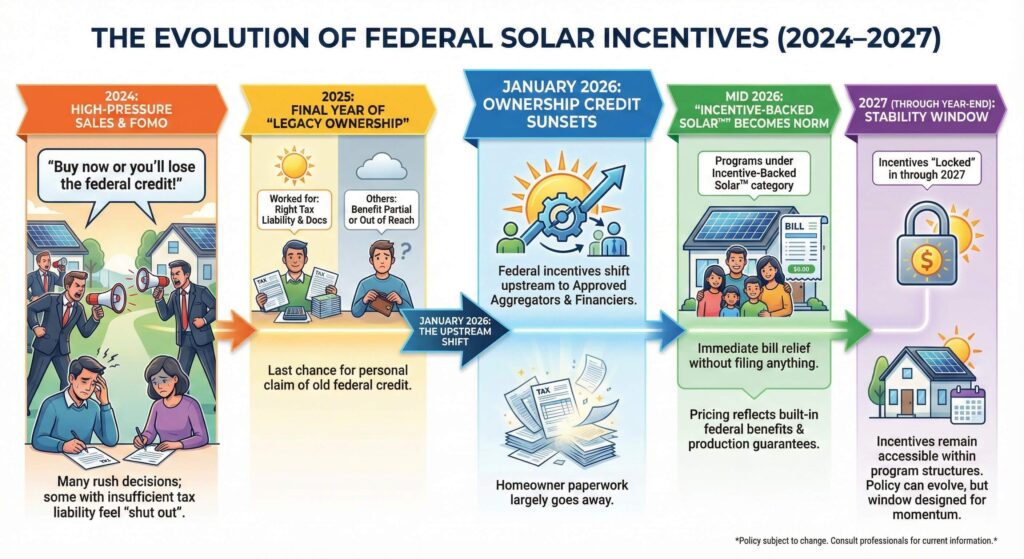

To make sense of the headlines, it helps to line up the dates. Here’s a simple timeline of how the federal transition rolled out and what it meant for homeowners at each step.

- 2024: Sales teams push ownership. The message is loud: “Buy now or you’ll lose the federal credit.” Many homeowners rush decisions based on that pressure, and some who couldn’t use the credit feel shut out.

- 2025: The final year homeowners could personally claim the old federal solar credit under Legacy Ownership. It worked for those with the right tax liability and documentation. For others, the benefit was partial or out of reach.

- January 2026: The ownership-based credit sunsets. Federal incentives don’t vanish, they shift upstream. Approved aggregators and financiers become the primary interface, applying benefits directly within qualifying plans. Homeowner paperwork largely goes away.

- Mid 2026: Programs under the Incentive-Backed Solar™ category become the norm. Pricing reflects built-in federal benefits and long-term production guarantees. Homeowners see immediate bill relief without filing anything.

- 2027 (through year-end): Incentives remain accessible within program structures, generally “locked” in through 2027 under current rules. As always, policy can evolve, but the 2026–2027 window is designed to maintain momentum in residential adoption.

So yes, the do-it-yourself credit ended. But the federal objective didn’t. The baton simply passed from individual homeowners to qualified entities that can streamline how the value reaches your home.

Who interfaces with federal incentives now

In 2026, you’re not the one filing for federal benefits. That role moved to organizations that can manage the paperwork and risk at scale. Here’s a plain-English breakdown of who does what and why it helps.

Who captures the benefits

Qualified aggregators and financiers interface with federal programs. They manage the compliance, documentation, and auditing risk. Because they operate across thousands of systems, they can standardize the process and price plans accordingly.

How those benefits show up for you

The captured value gets translated into your plan’s terms: a lower starting rate, built-in production guarantees, and full-service coverage. Instead of waiting for a credit, you see the benefit embedded in your monthly price and in the protections that back your system for the long haul.

Why homeowner paperwork went away

When the incentive lives inside the plan, there’s nothing left for you to claim. No tax liability requirement. No form to file next spring. No wondering what happens if your income changes. That’s the core promise behind Incentive-Backed Solar™: federal value, already applied, with fewer hoops.

What this means for your home in 2026

Let’s translate policy into real life. Under Legacy Ownership, you carried more risk and more chores: a big purchase, potential liens, warranty juggling, and the hope that a future credit would land. In 2026, the incentives are front-loaded into qualified plans, so your experience changes in practical ways.

Before vs after (quick reality check)

- Before (Legacy Ownership): Pay $25k–$40k or take a loan; hope your tax situation supports a credit next year; handle equipment issues yourself; watch insurance and lien questions.

- After (Incentive-Backed): $0 upfront in most cases; federal incentives applied in the plan; day-one savings targeted; 25-year production and service coverage standard in qualifying programs.

Here’s a simple example. Marisol in Connecticut signs in July 2026. Her plan is priced with federal value already built in, so her monthly solar rate under Incentive-Backed Solar™ is set below what her utility would have charged. She doesn’t file anything next April. If output ever dips, the production guarantee steps in. If a component fails, repairs are covered. And if she decides she wants ownership later, a buyout path exists, just like a car lease.

That’s the difference 2026 brought: the benefits didn’t leave the room; they were moved to the front of the contract. As detailed in our comprehensive guide to the new incentive setup, this shift also reduces friction when selling your home because plans are designed to transfer to the next homeowner cleanly.

The three most common misreads (and the truth)

Misunderstandings linger because 2025 messaging was loud and urgent. Here are the three mix-ups we hear most, plus the quick truth for each.

- Myth: “You missed out. No more federal help.”

Truth: Incentives shifted upstream. Approved programs apply them automatically so you don’t have to file anything. - Myth: “Ownership always saves more.”

Truth: In 2026, many homeowners see equal or better outcomes with Incentive-Backed plans because federal value and protections are built into the price from day one. - Myth: “It’s basically the same as 2025, just renamed.”

Truth: The structure is different. Legacy Ownership relied on your tax liability; 2026 programs deliver benefits inside the plan, with fewer risks and fewer chores for you.

Where this fits in the bigger picture

Policy changes are messy in real time. 2026 replaced a homeowner-filed credit with program-delivered incentives. The intent stayed the same: make clean energy accessible and predictable. For you, that means simpler onboarding, fewer forms, and protections that are clearer up front.

Bottom line for homeowners in 2026

Federal solar incentives didn’t vanish; they shifted to a model that’s easier to use. Instead of chasing a credit, you get pricing and protections with the federal value already baked in. Plans under Incentive-Backed Solar™ exist to make that shift visible on your utility bill and invisible in your paperwork.

Keep three points in mind:

- Incentives are still in play, they’re just applied differently in 2026–2027.

- Qualified providers handle the federal interface, which removes homeowner risk and chores.

- Your savings and coverage are designed to show up from day one, not at tax time.

Ready to see how Incentive-Backed Solar™ works for your home? Learn more about Incentive-Backed Solar™.