The New Solar Incentive Landscape in 2026: How Homeowners Still Benefit with Incentive-Backed Solar™

If you spent 2025 hearing “last chance for the tax credit,” you’re not alone. Plenty of homeowners walked away thinking they missed the window for meaningful solar savings. Here’s the thing: you didn’t. The incentives didn’t vanish. They moved.Quick Answer

Yes, federal solar incentives still exist in 2026. They’re applied inside Incentive-Backed Solar™ plans, not claimed on your taxes.- No tax paperwork or waiting for next year’s return

- Day-one savings with clear monthly pricing

- Fewer risks and full-system protections

What Changed with Federal Solar Incentives After 2025

For years, homeowners could claim a federal solar tax credit after buying a system. That structure ended after 2025. But the incentive value didn’t disappear. It shifted into program designs that apply the benefit upfront, inside the plan itself. Think of it this way: instead of doing complex tax math and hoping you have enough tax liability to capture the full value, the program does the math for you. The incentive is factored into your price from day one, so you see the impact immediately.Key Takeaway

The incentives didn’t disappear. They moved inside the plan.“The story changed in 2026: incentives aren’t something you file for later, they’re built into how your solar plan is priced today.”

Before 2026: How Homeowners Accessed the Old Credit

Here’s the simple version of the old process many homeowners remember:- Purchase a solar system with cash or a loan, often $20k–$40k.

- Wait until tax season to file for the federal credit.

- Claim the credit if you had enough tax liability to use it.

- Adjust expectations if your liability was too low, the credit didn’t always equal cash back.

- Manage warranties, maintenance, and performance risk yourself.

After 2025: How Incentives Work Now

With today’s programs, the incentive value is embedded in the plan from the start. You don’t have to qualify for or file anything with the IRS to unlock savings.- Incentives are applied automatically, so no tax forms or waiting.

- Monthly pricing reflects those incentives on day one.

- Coverage includes production guarantees, monitoring, and repairs.

- Flexibility to buy out later if ownership becomes your goal.

Who’s Most Affected by the Shift

Some homeowners were always at risk of missing the old tax credit’s full value. In 2026, those gaps are largely closed.- Retirees or anyone with low annual tax liability

- Households with variable income year to year

- Families who wanted savings now, not next spring

- Homeowners who prefer simple billing over tax paperwork

How Incentive-Backed Solar™ Works in 2026

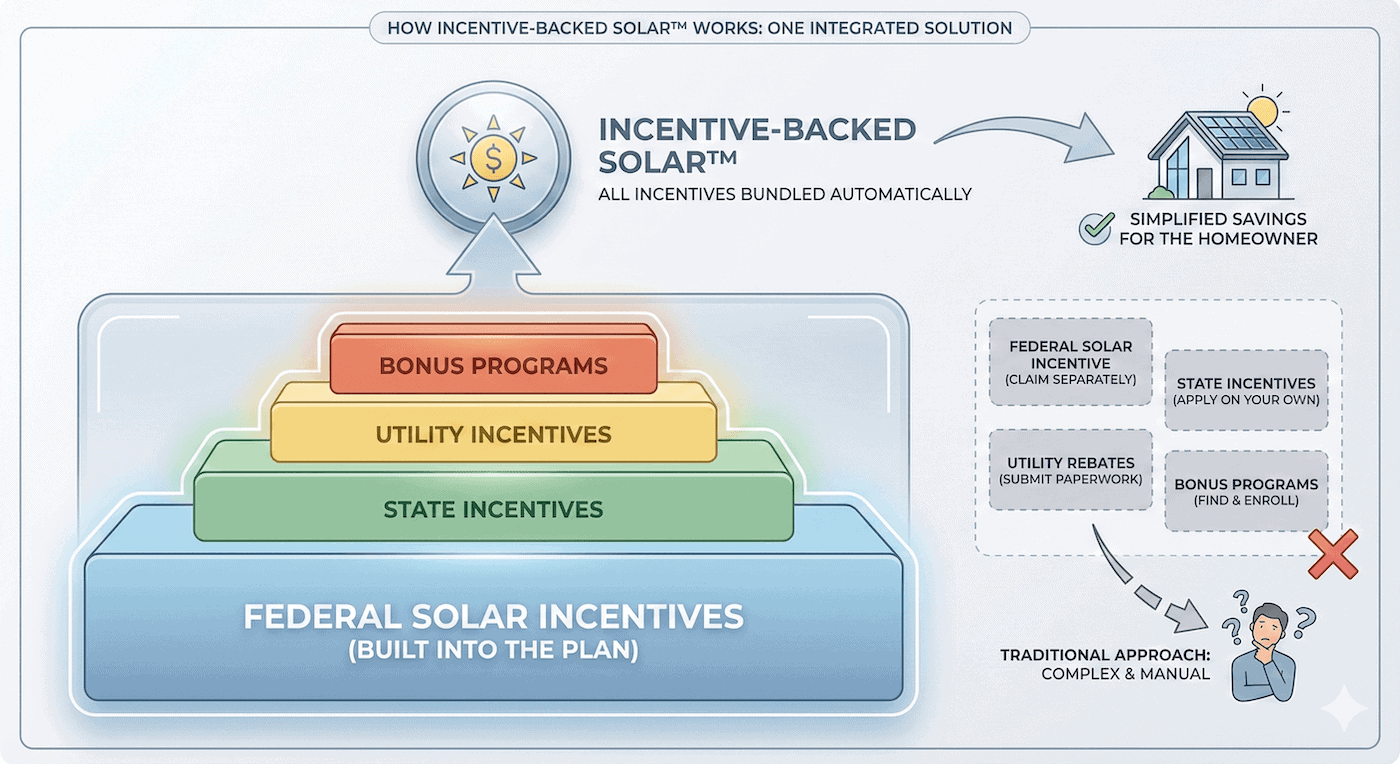

Incentive-Backed Solar™ is a category of programs that apply federal incentives inside the plan itself. We avoid outdated labels that carry baggage. It isn’t about a buzzword; it’s about how the benefits are delivered. The result is straightforward: simpler qualification, predictable savings, and stronger protection for your home and budget. Let’s be honest: the argument over “own vs. lease” was never about homeowners. It was about how systems were sold. In 2026, the conversation is different. Plans are designed around clarity and protection, not paperwork. Here’s what typically comes standard:- Incentives applied automatically, reflected in your monthly price

- Guaranteed day-one savings compared to your utility rate

- 25-year production guarantee and continuous monitoring

- No loan on your credit report and no property lien

- Homeowner’s insurance usually unaffected

- Flexible buyout path if you want to own later

- Easy transfer if you sell your home

“In 2026, the value didn’t vanish. It moved where homeowners can use it on day one.”

Built-In Incentives, Explained

Under Incentive-Backed Solar™, the financing partner and program structure apply the federal incentive value on your behalf. That means the monthly price you see already accounts for those dollars, so you’re not waiting for a tax season refund to make the math work. This is why monthly savings are predictable from the start. You’re comparing a known solar plan price, with protections included, to your utility bill. And because the incentive value is baked in, there’s no risk of “missing out” due to low tax liability.“It’s not a loophole. It’s how solar works now.”If you want more detail on how this compares to traditional buy-and-claim models, we break it down in our guide to Legacy Ownership vs. Incentive-Backed Solar™.

Eligibility, Protections, and Flexibility

Most homeowners qualify, but programs do have criteria. Here’s a quick snapshot of what to expect:- Eligibility is based on your roof, shade, and utility usage, not your tax liability.

- Plans include a 25-year production guarantee, monitoring, and repair coverage.

- No debt on your credit report; no lien recorded against your home.

- Insurance typically doesn’t change because the panels aren’t carried as your asset.

- If you move, the plan is designed to transfer cleanly to the next homeowner.

- Prefer to own outright later? There’s a buyout path, similar to choosing to purchase a vehicle at the end of a car plan.

Solar Tax Credit vs Built-In Incentives: What’s Different?

The old model hinged on a homeowner-claimed tax credit. In 2026, the incentive value is embedded in the plan. The dollars are still at work. They just show up in your monthly price instead of your tax return. Here’s how they compare at a glance:| Aspect | Old Tax-Credit Model (Pre-2026) | Built-In Incentives (2026) |

|---|---|---|

| Who Applies the Benefit | Homeowner files during tax season | Applied inside the plan automatically |

| Timing | Next tax season, delayed impact | Immediate, reflected in monthly price |

| Paperwork | IRS forms and eligibility rules | No tax paperwork required |

| Risk | Shortfall if tax liability is too low | No tax-liability risk |

| Cash-Flow Impact | Depends on refund timing and amount | Day-one savings vs utility rates |

| Complexity | High: multiple steps and assumptions | Low: benefits included by design |

- Built-in incentives remove the tax-liability barrier entirely.

- Your savings start immediately, without waiting for next year’s return.

- There’s no guessing game, your monthly plan already reflects the incentive value.

Key Takeaway

Built-in incentives simplify the process and reduce risk. No tax liability required. If you want more detail, read our guide on what changed for homeowners with the federal solar incentives.What You Can Still Qualify For in 2026

Good news: you don’t have to give up on solar incentives just because the old tax credit ended. In 2026, federal benefits are embedded inside the plan, and in many areas you can stack additional state, utility, or storage incentives on top. The amounts vary by region and change over time, but the categories are consistent, and they still add up. Think of today’s structure like a price that already includes the discount you used to chase later. Then, depending on where you live, other programs may further improve your monthly savings or boost your system’s performance value, especially if you add a battery. At a high level, here’s what homeowners commonly qualify for:- Federal incentives inside the plan: Already applied to your monthly price, with no separate filing or waiting.

- State-level benefits: Performance-based credits or state rebates where available.

- Utility programs: Net billing/net metering variants and time-of-use structures that reward smart production and storage.

- Battery/storage incentives: In some regions, separate benefits reduce the cost of adding backup power.

- Local adjustments: Municipal or county programs that may reduce soft costs or provide modest credits.

Federal Incentives Inside the Plan

With Incentive-Backed Solar™, the federal value is already baked into your plan price. You’ll see the impact on day one without hoping your tax return lines up perfectly months later. Simple example (illustrative only): if your average utility bill is $220, an eligible plan might price at $165 with protections included. That’s a $55 monthly difference from day one. You’re comparing today’s utility rate path against a clear solar price that already accounts for incentives, coverage, and performance guarantees. This structure is especially helpful for retirees or households with fluctuating income. No tax liability? No problem. The plan doesn’t rely on that. It’s designed to work without it.State, Utility, and Storage Add-Ons

State and utility benefits differ, but here are the typical ways they help. To see current programs in your area, consult the DSIRE database for up-to-date state, utility, and local incentives.- State performance credits: Modest monthly or quarterly credits based on production where programs exist.

- Utility rules: Net billing/net metering policies that credit exported energy and reward smart usage.

- Battery adders: Standalone storage incentives, where offered, that lower the cost of backup power and grid services.

Step-by-Step: How to Check Eligibility and Get Started

You might be wondering how to go from curiosity to clear numbers. For a plain-English overview, see DOE’s Homeowner’s Guide to Going Solar. The path is simple and mostly remote. You’ll see your plan price, protections, and day-one savings before you make any decisions. Here’s the typical sequence:- Submit a recent utility bill: We use 12 months when available to see usage patterns and seasonality.

- Remote roof and shade review: High-resolution imagery and design tools map your roof, sun exposure, and ideal panel layout.

- Custom proposal with built-in incentives: We show your plan price, projected production, and protections side-by-side with your current utility costs.

- Plan selection: Choose the configuration and term that balances savings, flexibility, and long-term goals.

- On-site survey: A technician verifies roof condition, electrical panel capacity, and final design details.

- Permitting and interconnection: We handle the paperwork with your town and utility; you stay informed without doing the legwork.

- Installation day: A licensed crew installs the system, typically in one to two days for most homes.

- Activation and monitoring: Once approved by your utility, your system turns on and performance monitoring begins.

- Your latest utility bill (or 12-month history if you have it)

- Property address and a rough idea of your roof’s age

- Any near-term plans to move or renovate

What to Expect on Your Consultation

Let’s be honest: nobody enjoys a hard sell. Your consultation is a working session focused on clarity. We’ll walk through your usage, roof layout, and plan pricing, then compare that to what you’re likely to pay your utility over the same period. We’ll also cover protections, the 25-year production guarantee, monitoring, and repair coverage, so you’re clear on who does what and when. If you’re curious about buyout options later or transfer steps if you sell, we’ll show exactly how those work.“No pressure, no gimmicks, just your numbers, your roof, and a straight comparison to staying with your utility.”Ready to see if your home qualifies? Check eligibility in minutes. Want a broader overview first? Explore the Incentive-Backed Solar™ hub for plain-English explainers.

Real-World Savings Scenarios and Protections

Numbers are useful, but real life is better. Here are a few anonymized scenarios to show how 2026 programs play out for different households. These are examples, not promises. Your actual results depend on your utility rates, roof, and usage. But the patterns are consistent.Retiree With Low Tax Liability

Profile: Single-story ranch, fixed income, average bill of $185/month, limited tax liability. Under the old model, capturing the full credit was uncertain. Today, the federal value shows up inside the plan price. Outcome: Plan price at $150/month with full monitoring and a 25-year production guarantee. That’s day-one savings of roughly $35/month, without depending on next year’s return. If production dips below the guaranteed level, the program makes it right. Why it works in 2026: No tax-liability barrier, no paperwork stress, and predictable cash flow every month. Protection is included, not tacked on.Young Family Avoiding New Debt

Profile: Growing household, planning a future move, average bill of $240/month, cautious about loans showing on a credit report. They want savings but don’t want new debt. Outcome: Plan price at $190/month with system monitoring and repairs included. Clear monthly savings from day one and no new loan on the credit report. If they choose to own later, there’s a defined buyout path. Why it works in 2026: It separates savings from borrowing. The plan is a utility alternative with built-in protections, not a loan that competes with other life goals.Mover Planning to Sell in 5–7 Years

Profile: Homeowner expects to relocate for work, average bill of $210/month. Interested in savings now but concerned about a clean exit later. Outcome: Plan price at $170/month with transfer terms spelled out up front. When it’s time to sell, the plan moves to the next homeowner with documented savings and a 25-year production guarantee, which becomes a selling point, not a complication. Why it works in 2026: Modern transfer terms are designed for real-world mobility. The next homeowner inherits protections and a clear monthly price that beats the local utility rate.“Savings are great; sleeping well is better, coverage and monitoring are built in.”Across all scenarios, the common thread is predictable savings with risk shifted away from the homeowner. Instead of hoping warranties line up and equipment vendors stay solvent, your plan includes production guarantees, monitoring, and repair responses for the long haul. Typical protections included:

- 25-year production guarantee: If actual production falls short of the guarantee, you’re compensated per the plan.

- Continuous monitoring: Performance is tracked, and issues are flagged proactively.

- Repairs and service included: Covered labor and parts for qualifying issues, so you’re not hunting down a manufacturer.

- Workmanship and roof coverage: Industry-standard workmanship coverage and roof penetration protection where applicable.

- Clear transfer and buyout paths: Transparent steps if you sell or decide to own later.

Key Takeaway

Day-one savings plus 25-year protection is now the default, not the exception.FAQs: Solar Incentives 2026

Are leasing-style programs a bad deal?

Short answer: no. The “never lease” advice came from a sales era when loans paid higher commissions. In 2026, Incentive-Backed programs aren’t about labels, they’re about how value and risk are handled. With Incentive-Backed Solar™, federal incentives are applied inside the plan, day-one savings are clear, and coverage is comprehensive for 25 years. You’re not crossing your fingers for next spring’s tax season to make the math work. For many homeowners, that’s a better consumer experience than taking on a five-figure loan and hoping warranties line up later. And if owning outright is still your endgame, the buyout path is there. Think of it like choosing a phone plan that includes insurance and upgrades versus paying full price up front, both can work, but only one wraps simplicity and protection into the monthly price.Am I too late to qualify for incentives in 2026?

You’re not late. The old homeowner-claimed tax credit ended, but the federal incentive value didn’t disappear. It shifted inside Incentive-Backed plans. That means you can still access meaningful savings without filing tax paperwork or meeting a tax-liability threshold. Availability is based more on your home’s roof, shade, and utility than on the calendar. That said, program terms and utility rules do evolve, and federal support is currently locked through 2027. The practical move is to confirm your eligibility and lock your pricing while these provisions are in place. It takes a few minutes to share a recent bill and get a clear read on your plan price, protections, and day-one savings. If you want to pressure-test the details, start with our quick check: see if your home qualifies.Do I still get federal incentives with Incentive-Backed Solar™?

Yes. You just don’t file for them yourself anymore. Under today’s structures, the federal incentive value is applied inside your plan, which is why your monthly price shows day-one savings versus your utility rate. There’s no IRS form and no waiting until next year’s return to see if you qualified for the amount you were counting on. That change removes a big source of uncertainty for retirees, households with fluctuating income, and anyone who didn’t love playing tax-season roulette. To be clear, this isn’t a loophole. It’s the updated way the market delivers support so homeowners benefit immediately.Will this affect my credit or put a lien on my home?

Not the way a loan would. Incentive-Backed Solar™ is designed without a loan on your credit report and without a property lien. That helps protect your buying power for other goals, like a future vehicle or home project. It also means you’re not stacking a new long-term debt on top of rising living costs just to get solar savings. The plan functions more like an alternative to your utility, with a locked-in structure and built-in protections, than like a personal loan. If you prefer to own the system outright later, a buyout path is available when the time is right for you. Until then, the plan keeps things simple: predictable pricing, coverage included, no debt on your report, and no lien against your property. For more background, see the CFPB’s overview of solar financing options.What happens if I sell my home?

Modern plans are built to transfer smoothly. If you sell, the next homeowner steps into a clear monthly price backed by a 25-year production guarantee and monitoring. That’s a feature, not a hurdle. Buyers increasingly value predictable energy costs, and having documented savings compared to the local utility can strengthen your listing. Practically, you’ll provide the plan documents during the sale process, just like you would for any home system with a service agreement. There isn’t a “gotcha” negotiation. The terms are transparent up front, and the buyer inherits protections that continue well beyond closing. If a buyer prefers ownership, a buyout option can be explored, but most choose to keep the predictable plan that already beats utility rates. For consumer tips on agreements and transfers, review the FTC’s guidance on solar contracts.What if something breaks or performance dips?

Your plan includes a 25-year production guarantee, active monitoring, and repair coverage. If production falls below the guaranteed level, you’re compensated according to the program’s terms. If equipment fails, the plan coordinates the fix, parts and labor for qualifying issues are covered, and you’re not left chasing multiple manufacturers. You’ll also have a monitoring app or portal so you can see system performance at a glance; most issues are flagged automatically so they can be addressed quickly. Your role is straightforward: keep your account connected, follow any basic maintenance guidance you receive (like keeping the monitoring online), and enjoy predictable savings while the program shoulders the technical responsibilities.How long do today’s incentives last?

The current federal support embedded in Incentive-Backed plans is locked through 2027. Beyond that, programs can change based on policy and market conditions. State and utility add-ons also shift over time, which is why we verify your address and utility rules when we build your proposal. The practical takeaway is simple: if your home qualifies in 2026 and the numbers look good, you can secure your terms while the incentives are active and known. If you’d rather keep researching, that’s fine too, just understand that waiting introduces the possibility of program adjustments outside anyone’s control. A quick consultation will show you what’s available now and how long the terms can be held for your project.Can I buy out later and own the system?

Yes. Incentive-Backed Solar™ includes a flexible path to ownership, similar to choosing to purchase a vehicle at the end of a plan. The buyout timing and price are defined in your agreement, so you’ll know your options up front. Many homeowners choose to keep the plan because it’s simple and fully covered; others buy out when it aligns with their financial goals. Either way, the choice is yours. If you do buy out, you transition to owning the equipment outright, much like Legacy Ownership, while the savings continue to come from the energy your system produces. During your consultation, we’ll walk through the buyout math so you can see how it compares to just staying on the protected plan.Bringing It All Together

Let’s be honest: the industry’s “last chance” drumbeat in 2025 left a lot of homeowners feeling like they missed out. But you didn’t. The incentive didn’t vanish; it moved. In 2026, the value shows up inside the plan, not on next spring’s tax return, which is exactly why savings are clearer and risks are lower. Bottom line: your decision isn’t between solar with incentives and solar without them. It’s between staying with utility rates you can’t control or choosing a plan that builds the incentive value, protections, and predictability into your monthly price. If your roof, shade, and usage fit, you can start saving without taking on new debt or filing tax paperwork. Want the quick path to real numbers? Share a recent bill and we’ll show your eligibility, plan price, and protections in a side-by-side comparison with your utility. No pressure, no fine print, just your options laid out clearly. Key takeaways to leave with:- Federal incentives still exist. They’re applied inside the plan for day-one savings.

- Coverage is the default: 25-year production guarantee, monitoring, and repairs included.

- No loan on your credit report, no property lien, and a clean transfer if you sell.