Rhode Island Solar Incentives and Programs

We may be the smallest state, but we're big on solar.

Find out how much you can save with the solar incentives and programs in our home state, Rhode Island.

Think you missed out on solar incentives? Think again. See how much you can save →

$1,240

Average Annual Savings

See immediate savings and watch them continue to stack up year after year.

40%

Lower Monthly Payment

Trade the unpredictable RI Energy bill for a lower, price-protected solar payment.

$0

Upfront Cost of Solar

With the incentives available in Rhode Island, the switch to solar is easy.

Rhodies Save

Rhode Island is taking the lead towards a sustainable future, powered by the sun. We’ve always been ahead with our environmental programs, so it’s no surprise that RI has some of the best solar incentives and rebates available.

Let’s shine a light on the biggest solar savings in the country, right here in the ocean state.

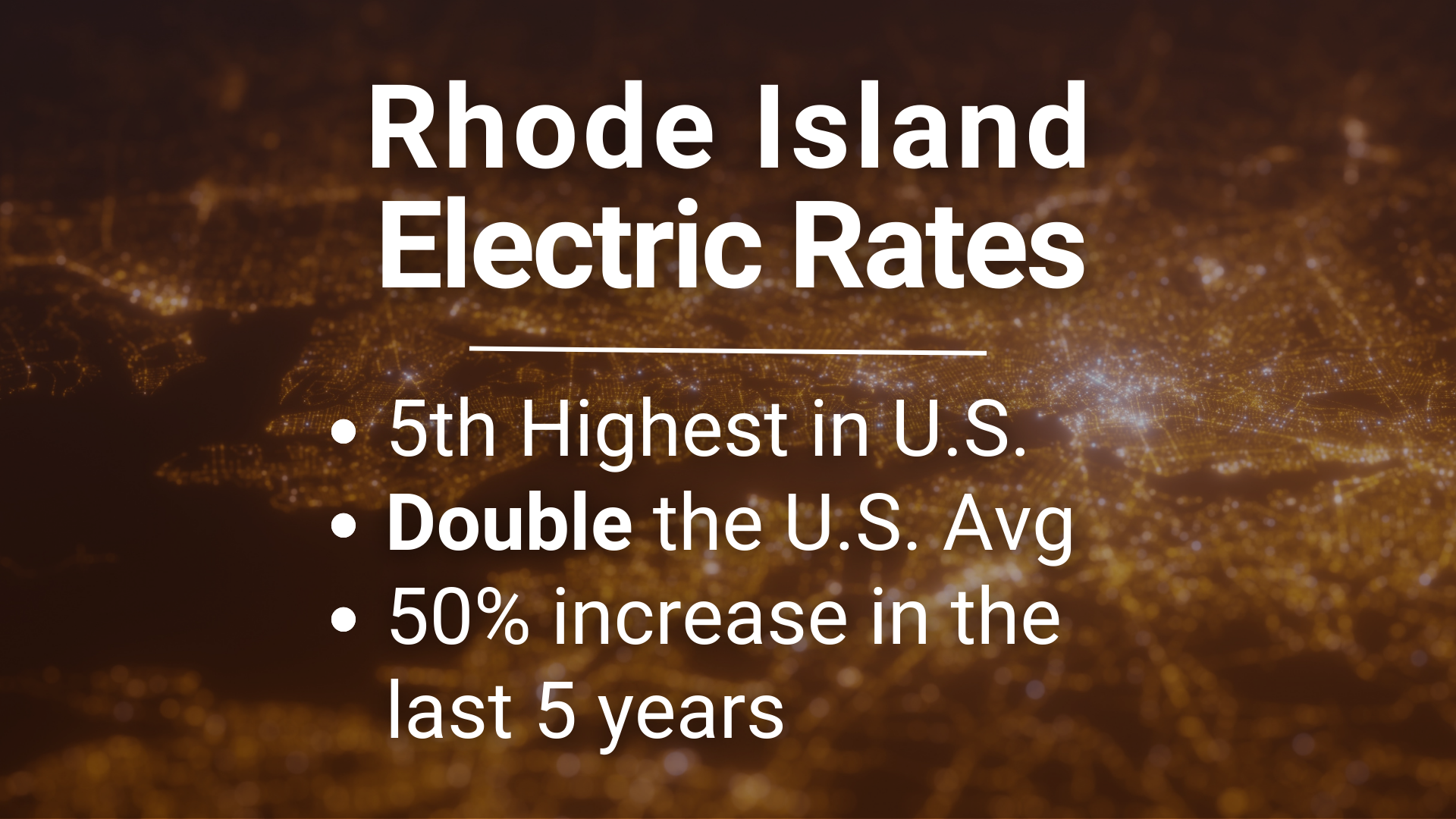

How Solar Power Compares to Rhode Island Energy Rates

Rhode Island energy rates are increasing faster than the number of Newport tourists in the summertime. We may be the smallest state, but we pay big bucks for electricity – a whopping double the national average. And just when we thought it couldn’t get any worse, electric rates jumped 50% in the last 5 years.

But don’t sweat it, Rhode Island – solar power is here to save the day and help you take control of your energy costs.

Rhodies Save

Rhode Island is taking the lead towards a sustainable future, powered by the sun. We’ve always been ahead with our environmental programs, so it’s no surprise that RI has some of the best solar incentives and rebates available. Let’s shine a light on the biggest solar savings in the country, right here in the ocean state.

How Solar Power Compares to Rhode Island Energy Rates

Rhode Island energy rates are increasing faster than the number of Newport tourists in the summertime. We may be the smallest state, but we pay big bucks for electricity – a whopping double the national average. And just when we thought it couldn’t get any worse, electric rates jumped 50% in the last 5 years.

But don’t sweat it, Rhode Island – solar power is here to save the day and help you take control of your energy costs.

Breaking Down an RI Electric Bill

48% of your bill is hidden fees and charges!

Delivery Charges...

Random, confusing charges like the “customer charge” and “energy efficiency program” make up 48% of your bill. Here are a couple key ones explained.

Distribution

Helps to support and maintain the poles, wires, and other infrastructure that gets the power from the main line to your home—makes 21% of your bill

Transmission

What the electric company charges you for transporting power from the supply source to local towers and lines—makes 14% of your bill

Finally—Actual Supply

And at last, we have the actual energy you’re buying. After all the other charges, supply only makes up 52% of your bill.

Solar Eliminates All These Charges

When you go solar, you no longer rely on the utility company to produce electricity—and no longer have to pay their ridiculous charges. Instead, you produce your own power with a low, locked-in solar rate.

Rhode Island

Solar Incentives and Rebates

The ocean state has some of the best solar incentives and state-funded programs around.

With the enactment of the “Big Beautiful Bill” on July 4, 2025, the solar tax credit has changed. Now, instead of homeowners having to qualify for and claim the federal tax credit themselves, the savings are automatically applied through solar leases and power purchase agreements (PPAs).

This means everyone can benefit from the value of the credit without extra steps or stipulations — the savings are built right into your plan. The result is lower monthly payments and a more affordable way to enjoy clean, reliable solar energy.

Rhode Island homeowners are exempt from paying any additional property taxes on the added home value from their Rhode Island solar panel system.

Rhode Island Homeowners are exempt from paying the normal 7% state sales tax on their solar panel system.

Some Rhode Island residents may qualify for up to $7,000 in state grant funds designated for green energy programs.

Rhode Islanders earn a utility credit for any energy that they overproduce. This credit can then be used to power your home at night and on cloudy days. This allows you to power your entire home without relying on solar batteries.

How to Claim the RI Solar Energy Incentives

We take care of everything aside from filing your taxes for you next year. While you should certainly consult a tax professional, we always make sure our customers are taking full advantage of any federal and state solar incentives. This includes providing alternative options such as leasing or power purchase agreements in the event that you don’t qualify for the incentives.

Rhode Island Solar Incentives and Rebates

The ocean state has some of the best solar incentives and state-funded programs around.

With the enactment of the “Big Beautiful Bill” on July 4, 2025, the solar tax credit has changed. Now, instead of homeowners having to qualify for and claim the federal tax credit themselves, the savings are automatically applied through solar leases and power purchase agreements (PPAs). This means everyone can benefit from the value of the credit without extra steps or stipulations — the savings are built right into your plan. The result is lower monthly payments and a more affordable way to enjoy clean, reliable solar energy.

Rhode Island homeowners are exempt from paying any additional property taxes on the added home value from their Rhode Island solar panel system.

Rhode Island Homeowners are exempt from paying the normal 7% state sales tax on their solar panel system.

Some Rhode Island residents may qualify for up to $7,000 in state grant funds designated for green energy programs.

Rhode Islanders earn a utility credit for any energy that they overproduce. This credit can then be used to power your home at night and on cloudy days. This allows you to power your entire home without relying on solar batteries.

We took the complicated part and made it easy.

You still get the benefits of today’s federal solar incentives, we just handle the mechanics behind the scenes so you can focus on the savings.

1.

30% Federal Solar Investment Tax Credit (ITC)

You can claim a tax credit for 30% of the total cost of your solar system. While this can be claimed by the homeowner when the solar panels are purchased, this credit has also reduced the cost of leasing solar panels, making the switch to solar more affordable today than ever. In order to claim the full tax credit for ownership, you need to have enough tax liability. If you don’t have tax liability, other options like leasing or power purchase agreements may be better options.

2.

Property Tax Exemption for Renewable Energy Systems

Rhode Island homeowners are exempt from paying any additional property taxes on the added home value from their Rhode Island solar panel system.

3.

Renewable Energy Sales Tax Exemption

Rhode Island Homeowners are exempt from paying the normal 7% state sales tax on their solar panel system.

4.

Rhode Island Renewable Energy Fund

Some Rhode Island residents may qualify for up to $7,000 in state grant funds designated for green energy programs.

5.

Rhode Island Net Energy Metering

Rhode Islanders earn a utility credit for any energy that they overproduce. This credit can then be used to power your home at night and on cloudy days. This allows you to power your entire home without relying on solar batteries.

How to Claim the RI Solar Energy Incentives

We take care of everything aside from filing your taxes for you next year. While you should certainly consult a tax professional, we always make sure our customers are taking full advantage of any federal and state solar incentives. This includes providing alternative options such as leasing or power purchase agreements in the event that you don’t qualify for the incentives.

We took the complicated part and made it easy.

You still get the benefits of today’s federal solar incentives, we just handle the mechanics behind the scenes so you can focus on the savings.

Made-In-America Bonus Credit

There are federal incentives available to solar installers who use American-made panels. While other companies may use panels made overseas, Evergreen’s panels are made in Georgia, USA, and help you save even more money when you switch to solar.

Made-In-America Bonus Credit

There are federal incentives available to solar installers who use American-made panels. While other companies may use panels made overseas, Evergreen’s panels are made in Georgia, USA, and help you save even more money when you switch to solar.

Can you get free solar panels in Rhode Island?

While you can’t technically get “free” solar panels anywhere, they are “free” in the sense that you can expect to pay less for solar than you already do for electricity — and it costs nothing to make the switch.

So you’re swapping out an unpredictable and constantly increasing electric bill for a price protected solar payment that is usually about 40% lower. While it isn’t exactly “free”, it’s about as close as it gets.

Can you get free solar panels in Rhode Island?

While you can’t technically get “free” solar panels anywhere, they are “free” in the sense that you can expect to pay less for solar than you already do for electricity — and it costs nothing to make the switch.

So you’re swapping out an unpredictable and constantly increasing electric bill for a price protected solar payment that is usually about 40% lower. While it isn’t exactly “free”, it’s about as close as it gets.

Bundle Roof + Solar

and Get Your Roof

“On the House”

Solar makes so much sense in Rhode Island that you can actually get a full roof replacement when you switch to solar and still pay less than traditional electricity.

With our Roof + Solar Bundle, we handle everything under your solar project, saving you time and money.

Bundle Roof + Solar

and Get Your Roof

"On the House"

Solar makes so much sense in Rhode Island that you can actually get a full roof replacement when you switch to solar and still pay less than traditional electricity. With our Roof + Solar Bundle, We handle everything under your solar project, saving you time and money.